When Do You Need a Personal Financial Statement?

Personal property such as jewelry or carsĮxamples of personal liabilities include:ĭon’t include business assets or liabilities in your personal financial statement. Your net worth can be either positive (if you have more assets than liabilities) or negative (if you have more liabilities than assets). To get your net worth, subtract liabilities from assets. It lists your assets (what you own), your liabilities (what you owe), and your net worth. A personal financial statement is a snapshot of your personal financial position at a specific point in time. For more information, please see our Privacy Policy Page.If you’re trying to get a business loan from a bank or financing from an investor, they may ask you for a personal financial statement. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. This can affect which services appear on our site and where we rank them. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. Our mission is to help consumers make informed purchase decisions. Clarify all fees and contract details before signing a contract or finalizing your purchase. For the most accurate information, please ask your customer service representative. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. You can also see how much total interest you’ll have paid and the remaining loan balance with each SBA loan payment.ĭisclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing.

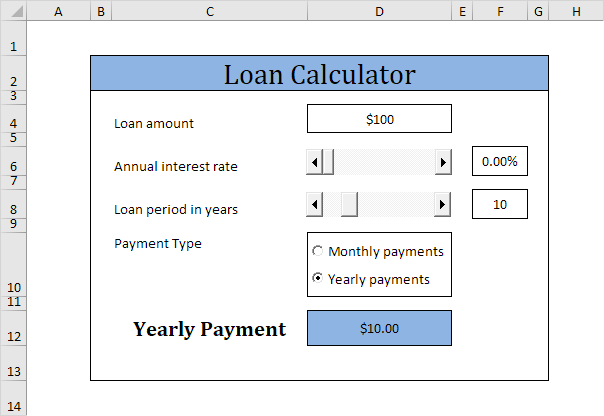

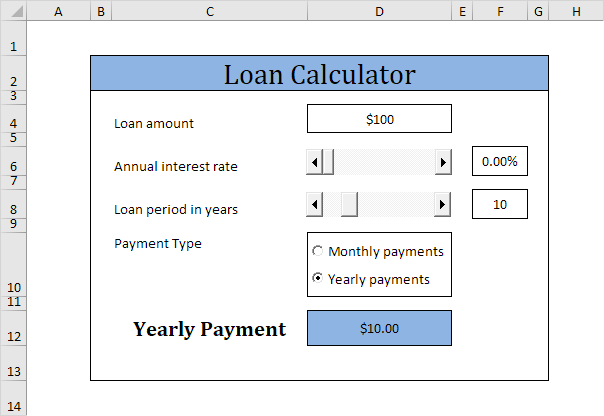

This table will break down how much of each payment is interest and how much of it is principal. The amortization schedule lets you see each scheduled monthly payment. As you can guess, the higher your interest, the more you should expect to pay over the loan term. This number includes your loan principal (the amount you borrowed) and the interest you pay. With the total loan payback amount, you can see how much you’ll pay over the loan term. If you don’t, you should look for a smaller loan or a lower interest rate.

If you have enough spare working capital to pay the loan, you’re all set to borrow.

You’ll want to compare this number to your regular monthly cash flow. The estimated monthly payment will help you decide if you can afford to pay back the loan. Total payback amount (principal plus interest).These results will give you some helpful data:

0 kommentar(er)

0 kommentar(er)